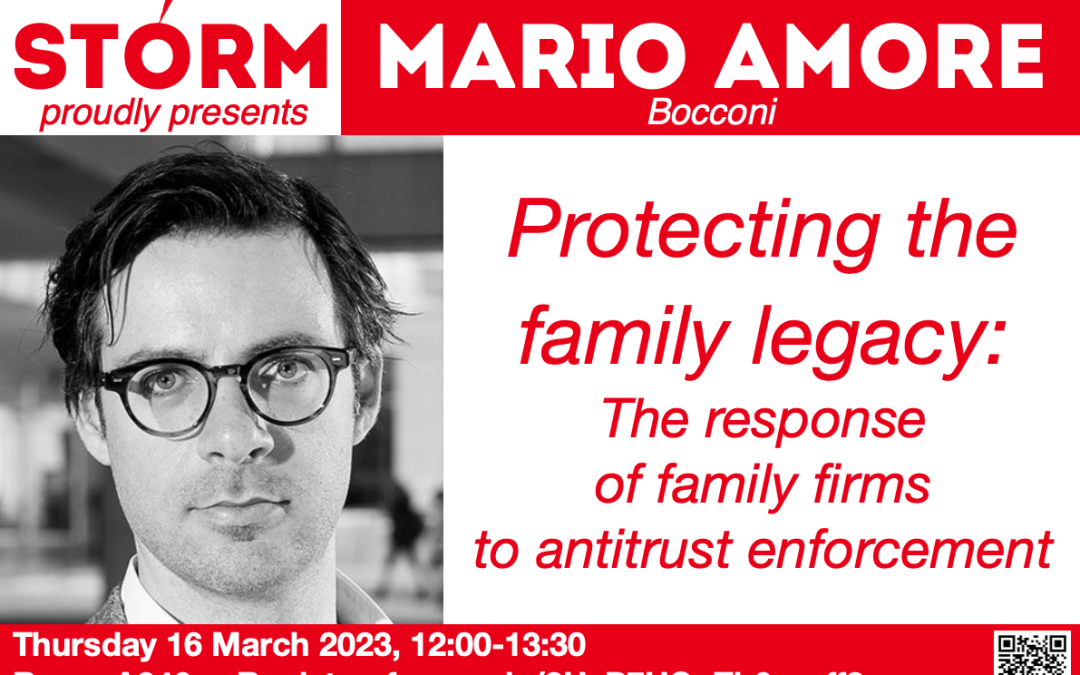

Protecting the family legacy: The response of family firms to antitrust enforcement.

About the Research

Prosecution for antitrust violations can be costly due to increased competitive threats and reputational damages. Although firms’ financial responses to such violations have been studied, we know little about how these differ across owner identities. We argue that family owners’ responses to antitrust enforcement actions are distinctive, bringing to bear intangible assets in the form of symbolically and socially significant family leadership to restore reputation. Whereas nonfamily firms raise equity capital and invest to cope with the effects of antitrust actions, to preserve control, families avoid diluting their ownership and invest less. However, because family and firm reputation and economic wealth are closely tied, family owners dismiss the old guard and recruit trusted senior family leaders to restore stakeholder confidence, especially when the antitrust enforcement leads to sanctions and reputational exposure is high. Bringing in these family executives speeds market share recovery. In short, family firms do less financially while leveraging family leadership. These notions are supported in a major longitudinal study of responses to antitrust enforcement actions by Italian firms.

About Mario Amore

I am Full Professor at Bocconi University and Director of the PhD Program in Business Administration & Management at Bocconi University. I am Research Affiliate at the Center for Economic Policy Research (CEPR) and Research Member at the European Corporate Governance Institute (ECCGI). I hold a PhD in Economics and Management from Copenhagen Business School. My research interests include corporate governance, family business and corporate finance. Furthermore, I am interested in the interactions between strategy, finance and innovation, and the behavioral aspects of corporate decision-making. My works have been published in leading journals such as Management Science, Journal of Financial Economics, Strategic Management Journal and Organization Science. My research has also been featured in media outlets such as Harvard Business Review, The Wall Street Journal, Harvard Law School Forum on Corporate Governance and Bloomberg. I currently serve as Associate Editor of Management Science and Journal of Corporate Finance, and Editorial Review Board Member of Strategic Management Journal.

Date: Thursday 16 March, 2023

Time: 12:00-13:30 CET

Venue: A346 (Zoom link provided to registered attendees)

Should you want to attend, please register at https://forms.gle/rYxqPmw7cZsCrsHU8