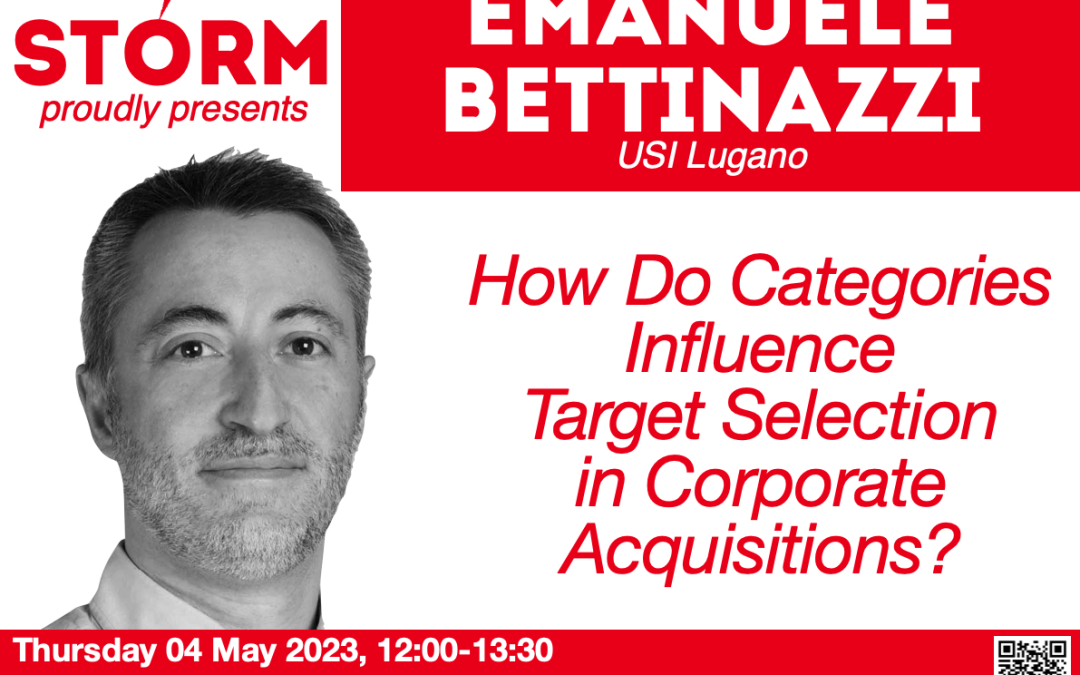

How do categories influence target selection in corporate acquisitions?

About the Research

In the M&A market, the risk of adverse selection is an essential concern for prospective acquirers when they perceive a potential target to display high levels of information asymmetry. Prior research focused on how signals and network links can increase the information available to prospective acquirers; however, perceived information asymmetry is not solely a function of how much information is available to prospective acquirers but also of cognitive factors that contribute to shaping this perception. Drawing on extant research in economic sociology, we introduce market categories as one such factor. Specifically, we propose that by portraying their activities as typical of pre-existing market categories, potential targets may reduce prospective acquirers’ perception that they are subjected to information asymmetry, increasing the likelihood of being selected for acquisition. To test this hypothesis, we use a sample of 9,061 US-listed firms between 1995 and 2018, representing the whole population of listed firms net of missing data. Our measure of self-portrayed typicality is based on word embeddings applied to annual reports (10-K forms), used as a proxy for firms’ self-depiction of their activities. In line with our expectations, we find that firms self-portrayed as typical are more likely to be acquired. In additional analyses, we further find that (a) the influence of typicality is lower at decreasing levels of categorical clarity, and (b) acquirers tend to take more time and hire more advisors to complete acquisitions of firms self-portrayed as typical. This suggests that, in line with our hypothesized mechanism, a target’s self-portrayed typicality fosters the perception that typical firms are easier to make sense of but that this perception may prove inaccurate, leading to an increase in information gathering after the deal announcement. Further, we identify a set of boundary conditions for the proposed relationship.

About Emmanuele Bettinazzi

Emanuele L. M. Bettinazzi is an Assistant Professor of corporate strategy at USI. He holds a Ph.D. in Business Administration and Management from Bocconi University and a Master of Research in Management from ESADE Business School. Before joining USI, he held an Assistant professor position at EMLYON business school (France). Most of his current research interests lie at the intersection between corporate strategy and stakeholder theory. In particular, his research focuses on the influence of stakeholder relationships on firms’ modes of growth, corporate strategy performance, and learning mechanisms. His works have been published in the Strategic Management Journal, Academy of Management Journal, Journal of Management Studies, and Strategic Organization, among others.

Date: Thursday 4 May, 2023

Time: 12:00-13:30 CET

Venue: Training Room (Zoom link provided to registered attendees)

Should you want to attend, please register at https://forms.gle/rYxqPmw7cZsCrsHU8